OppenheimerFunds 403b7 Distribution Form Instruction Booklet free printable template

Show details

Please note that OppenheimerFunds does not perform any withholding for purposes of state or local law. Accordingly you should consult your tax advisor for additional guidance. Any distribution from a 403 b is reported to the IRS as a distribution taken in the calendar year the shares are redeemed from the account. The distribution is reported on IRS Form 1099R. A copy of this form is mailed to your address of record in January of the following year to be filed with your tax return. If you...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oppenheimer ira distribution request form

Edit your oppenheimer funds withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oppenheimer funds forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to withdraw from oppenheimer funds online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oppenheimer 403b forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

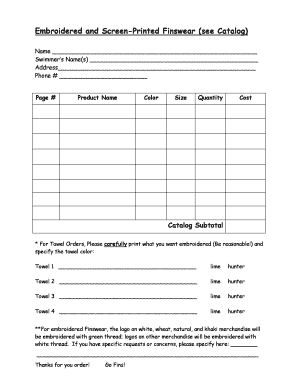

How to fill out oppenheimer funds transfer form

How to fill out OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet

01

Begin by downloading the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet from the official website.

02

Read the introductory section to understand the purpose of the form and the types of distributions available.

03

Locate the section that outlines the required information and documentation you need to fill out the form.

04

Carefully fill in your personal information, including your name, address, Social Security number, and account number.

05

Specify the type of distribution you are requesting (e.g., full withdrawal, rollover, etc.) in the designated section.

06

If applicable, provide details on your beneficiary or any other relevant party involved in the distribution process.

07

Review the tax implications and select the appropriate tax withholding option based on your preferences.

08

Sign and date the form at the end, ensuring all information is accurate and complete.

09

Submit the completed form according to the instructions provided, either via mail or electronically.

Who needs OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

01

Employees who participate in an OppenheimerFunds 403(b)(7) retirement plan and wish to request a distribution from their account.

02

Individuals who are considering retirement or leaving their job and need to access their retirement funds.

03

Beneficiaries who need to claim distributions from a deceased participant's account.

Fill

oppenheimer tax forms

: Try Risk Free

People Also Ask about oppenheimer funds 403b

How do I avoid 20% tax on my 401k withdrawal?

One of the easiest ways to lower the amount of taxes you have to pay on 401(k) withdrawals is to convert to a Roth IRA or Roth 401(k). Withdrawals from Roth accounts are not taxed.

How do retirement distributions work?

When you withdraw funds from your 401(k) before you turn 59½, you'll typically be hit with a 10 percent penalty. But once you turn 59½, that penalty is waived. At this point, you can begin taking withdrawals (technically known as distributions) as you please.

What is the recommended retirement distribution?

Finding the right withdrawal strategy As a starting point, Fidelity suggests you consider withdrawing no more than 4% to 5% from your savings in the first year of retirement, and then increase that first year's dollar amount annually by the inflation rate. But from which accounts should you be taking that money?

Should I take 5% or 4% in retirement?

As an estimate, aim to withdraw no more than 4% to 5% of your savings in the first year of retirement, then adjust that amount every year for inflation.

What is the 70% rule of thumb for retirement?

One rule of thumb is that you'll need 70% of your pre-retirement yearly salary to live comfortably. That might be enough if you've paid off your mortgage and are in excellent health when you kiss the office good-bye.

What is the difference between 401k withdrawal and distribution?

A 401(k) distribution occurs when you take money out of the retirement account and use it for retirement income. If you have taken money from your account before 59 1/2 years of age, you have made a withdrawal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oppenheimer ira distribution form for eSignature?

When you're ready to share your oppenheimer funds 1099, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute oppenheimer simple ira application online?

Completing and signing oppenheimer funds tax forms online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in oppenheimer forms?

With pdfFiller, the editing process is straightforward. Open your oppenheimer tax documents in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

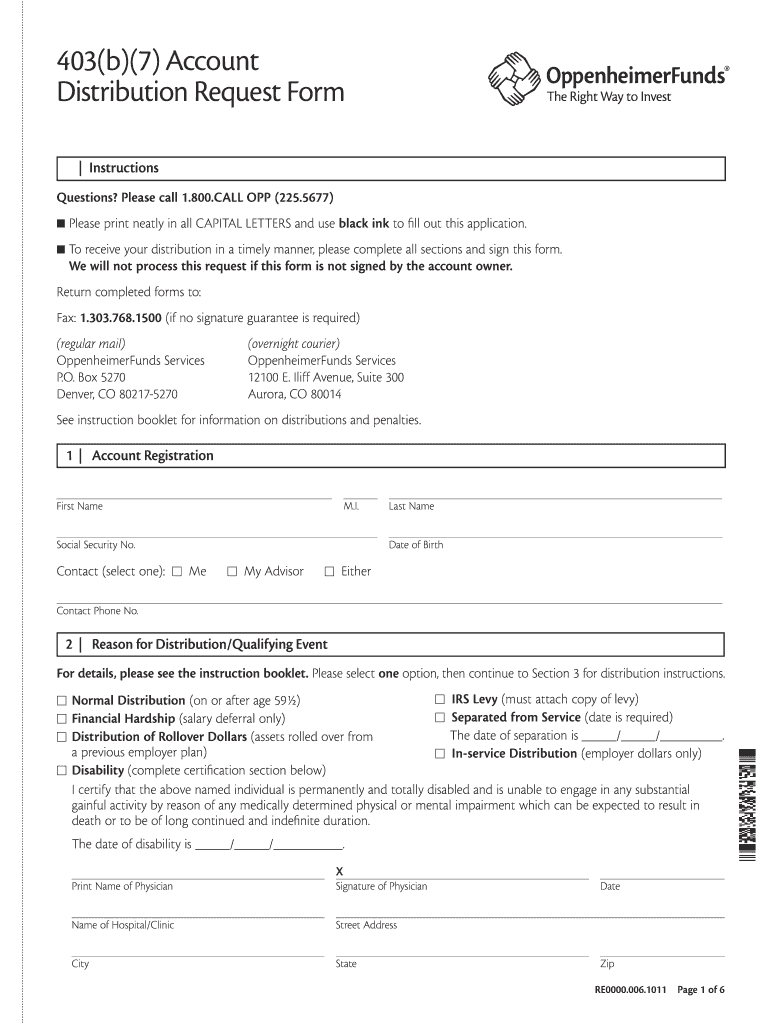

What is OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

The OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet is a guide that provides instructions on how to properly complete the distribution form for a 403(b)(7) retirement plan, which is a type of tax-advantaged savings plan for public education organizations and certain non-profits.

Who is required to file OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

Those who are withdrawing funds from their OppenheimerFunds 403(b)(7) retirement account or are requesting a distribution from their account are required to file the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet.

How to fill out OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

To fill out the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet, individuals should follow the step-by-step instructions provided in the booklet, including filling in personal information, specifying the type of distribution requested, and providing any necessary documentation required for the process.

What is the purpose of OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

The purpose of the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet is to assist individuals in understanding the distribution process, ensuring they complete the necessary forms accurately to facilitate their withdrawal or transfer requests from their 403(b)(7) accounts.

What information must be reported on OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet?

The information that must be reported on the OppenheimerFunds 403(b)(7) Distribution Form Instruction Booklet includes personal identification details, account number, type of distribution (e.g., hardship, loan, rollover), and any relevant tax information that is required for processing the distribution.

Fill out your OppenheimerFunds 403b7 Distribution Form Instruction Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oppenheimer Funds Change Of Beneficiary Form is not the form you're looking for?Search for another form here.

Keywords relevant to oppenheimer 403b

Related to oppenheimer funds state tax information 2017

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.